Resources

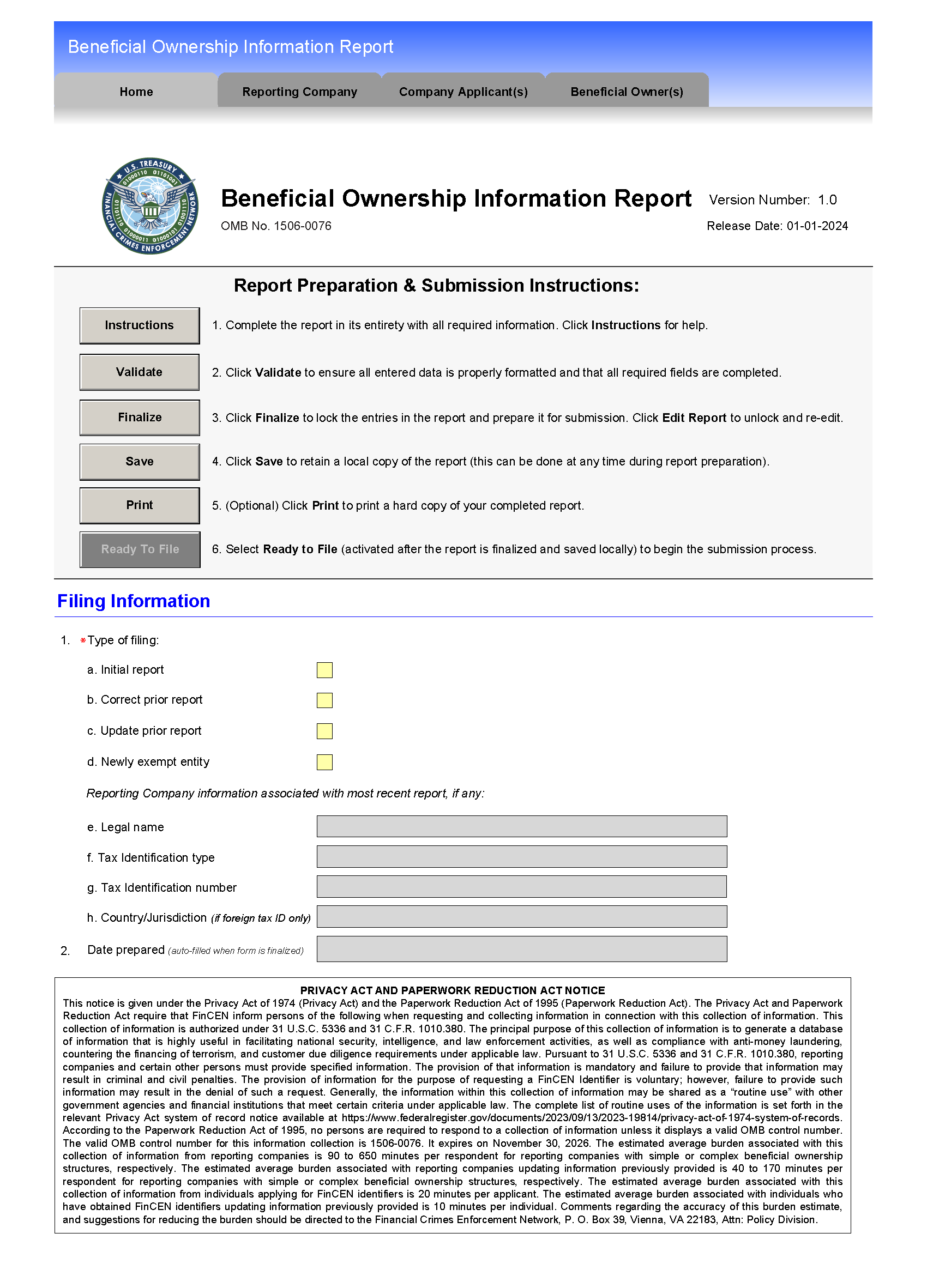

Beneficial Ownership Information Reporting

A reporting company created or registered to do business before January 1, 2024, will have until January 1, 2025 to file its initial beneficial ownership information report.

A reporting company created or registered on or after January 1, 2024, and before January 1, 2025, will have 90 calendar days after receiving notice of the company’s creation or registration to file its initial BOI report. This 90-calendar day deadline runs from the time the company receives actual notice that its creation or registration is effective, or after a secretary of state or similar office first provides public notice of its creation or registration, whichever is earlier.

Reporting companies created or registered on or after January 1, 2025, will have 30 calendar days from actual or public notice that the company’s creation or registration is effective to file their initial BOI reports with FinCEN.

https://www.fincen.gov/boi

Misc Links and Payroll Forms

New Employees must fill out many forms. The most common are below

I-9 Form can be found at https://www.uscis.gov/sites/default/files/document/forms/i-9.pdf

W-4 Form can be found at https://www.irs.gov/pub/irs-pdf/fw4.pdf

W4MN Version can be found at https://www.revenue.state.mn.us/sites/default/files/2023-12/w-4mn.pdf

MILEAGE: Beginning on Jan. 1, 2024, the standard mileage rates for the use of a car (also vans, pickups or panel trucks) will be as follows:

67 cents per mile driven for business use, up 1.5 cents from 2023.

21 cents per mile driven for medical or moving purposes for qualified active-duty members of the Armed Forces, a decrease of 1 cent from 2023.

14 cents per mile driven in service of charitable organizations; the rate is set by statute and remains unchanged from 2023.

*These rates apply to electric and hybrid-electric automobiles as well as gasoline and diesel-powered vehicles.

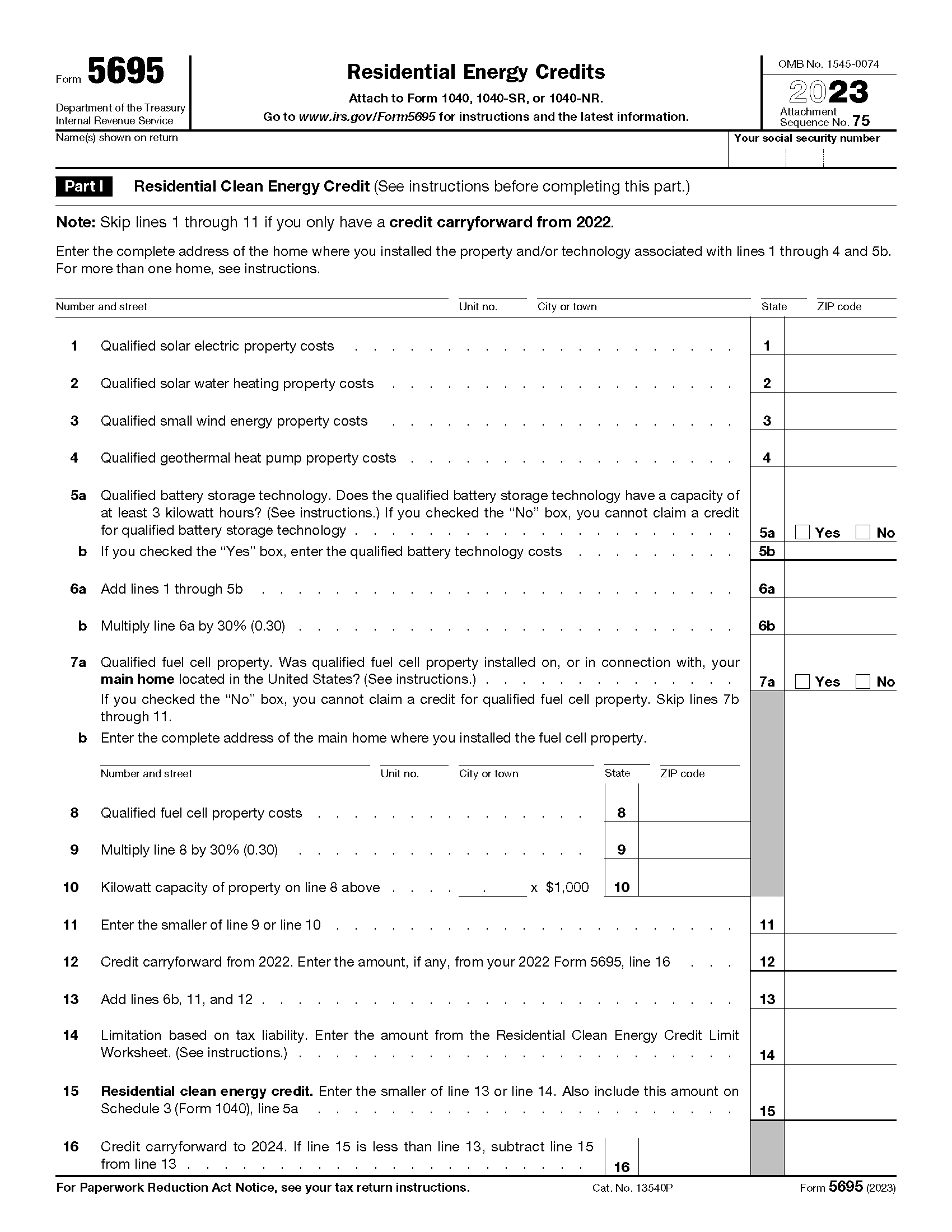

Residential Energy Credits

The Residential Clean Energy Credit equals 30% of the costs of new, qualified clean energy property for your home installed anytime from 2022 through 2032. The credit percentage rate phases down to 26 percent for property placed in service in 2033 and 22 percent for property placed in service in 2034. You may be able to take the credit if you made energy saving improvements to your home located in the United States.

The credit is nonrefundable, so the credit amount you receive can't exceed the amount you owe in tax. You can carry forward any excess unused credit, though, and apply it to reduce the tax you owe in future years. Do not include interest paid including loan origination fees.

The credit has no annual or lifetime dollar limit except for credit limits for fuel cell property. You can claim the annual credit every year that you install eligible property until the credit begins to phase out in 2033.

Find out more about Form 5695 https://www.irs.gov/pub/irs-pdf/f5695.pdf